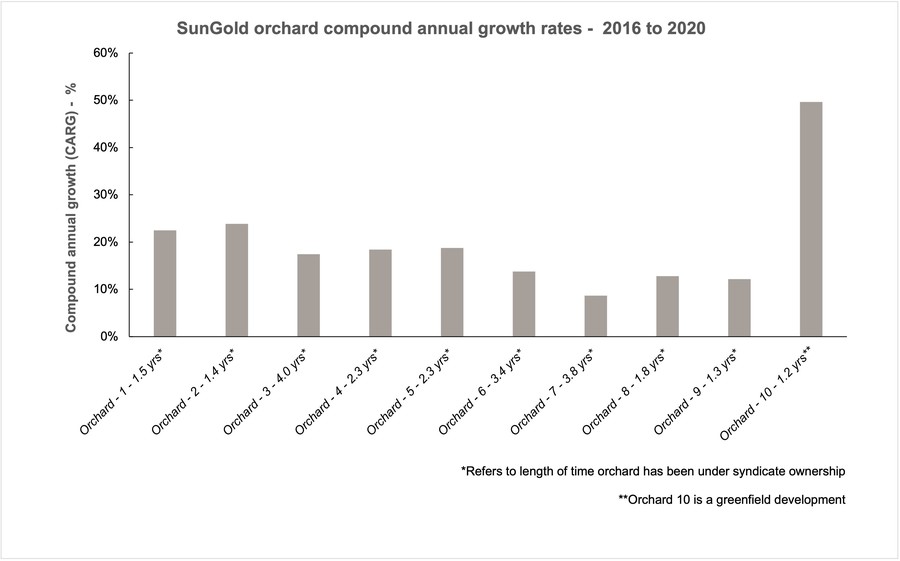

The MyFarm portfolio experienced stellar asset value growth in 2021. The best example comes from independent valuations carried out in October 2021 for 10 MyFarm kiwifruit orchards purchased prior to 2020.

This portfolio has increased in value by $40 million since purchase – on average the annual compound growth has been 21% p.a. since the orchards were purchased.

MyFarm is seeing similar value appreciation for vineyards, rural commercial property, manuka plantations, new forestry blocks and bare land with good access to water. This is a great endorsement of our ability to identify and source assets that can deliver the level of return investors expect, purchasing when we are confident of delivering investment performance and before significant asset price appreciation occurs.

The story behind the numbers

In 2017 MyFarm took the early opportunity to invest in the kiwifruit sector as the potential of the SunGold variety was emerging as a key ingredient in the industry’s recovery from the effects of Psa.

MyFarm was attracted to the sector’s very high operating margins of 50-60% providing the ability to pay regular distributions. Gold orchard productivity was also climbing steadily as a result of improving orchard management and Zespri’s investment in brand marketing and channel development. This was driving year on year average price lifts despite growing fruit volumes.

Since 2017, we’ve enabled our investors to purchase 15 SunGold kiwifruit orchards at different stages of development through to full maturity. In total the properties represent 146 cha of which 123 cha is in SunGold kiwifruit with mature orchards producing from 13,000 trays/cha to over 17,000 trays/cha.

MyFarm is currently offering the opportunity to invest in the SunGold kiwifruit orchard sector, through Gold Income Limited Partnership. This is an investment in two geographically diverse orchards, 'Stanners Rd' in Kerikeri and 'Rangitaiki' in Eastern Bay of Plenty. MyFarm targets cash returns of 6.5-8% p.a. To see videos of these orchards and review this offer click here.