Borrowers received the first glimmer of much-wanted relief when the Reserve Bank cut the Official Cash Rate (OCR) by 0.25% to 5.25% at their meeting on 14th August1.

The RBNZ had earlier noted2 that its estimate of the long-term neutral OCR was 2.75%, so the August cut appears to be the start of a much-needed easing cycle likely to run through to late 2025 or early 2026.

This outlook for a cut of 2.75% from the highs of the past year is great news for borrowers but may require a change of strategy for savers.

Prior to the announcement, bank term deposits were offering rates of over 6% p.a. for a one-year term – providing income investors with ready access to steady returns. Since the RBNZ announcement, these rates have already dropped, with the mainstream banks now offering 5.2% p.a for those same one-year term deposits. Craigs Investment Partners estimate that if the OCR continues to drop in line with forecasts, term deposit rates could dip to around 4.5% p.a within a year, and below 4% p.a. within two years. This would mean a dramatic 35-40% fall in bank deposit income.

So where can investors now look to access opportunities for income returns above 6% p.a?

As interest rates fall, investments in land-based assets can become more attractive and can benefit from two compounding factors. First, lower than anticipated interest costs can boost returns, and then over the longer-term, a lower cost of capital can lead to increasing property values.

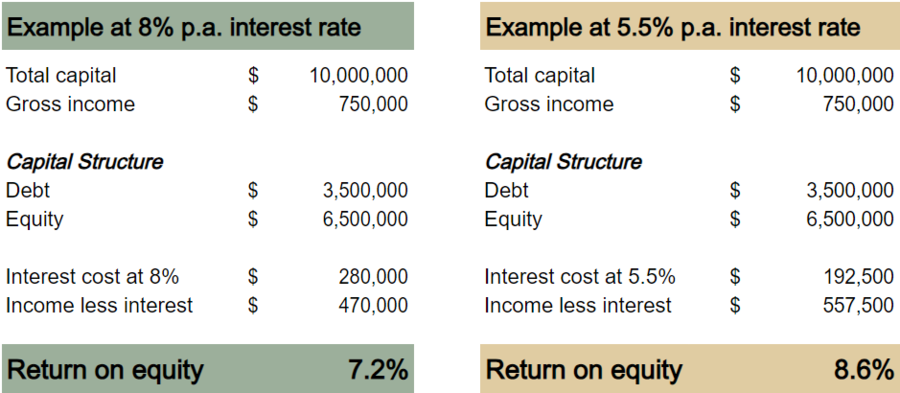

The below example illustrates the impact of falling interest rates on investor returns on a land-based asset. In this scenario, the asset is earning $750,000 of lease income each year and was purchased for $10,000,000. Of this capital, $3,500,000 is debt and $6,500,000 is investor equity.

You can see that at a mortgage interest rate of 8%, the annual cost of interest payments is $280,000 on the $3,500,000 of debt, giving a return of 7.2% p.a on the investors’ equity. As interest rates (and therefore mortgage interest costs) fall, investor returns increase – in the example, you can see returns on investor equity increase to 8.6% p.a at an interest rate of 5.5% p.a.

Note that the model is aimed at showing the impact of interest costs and so it is simplified, with the only variable being interest costs.

1. Reserve Bank of New Zealand (August 2024), OCR 5.25% - Monetary restraint tempered as inflation converges on target

OCR 5.25% - Monetary restraint tempered as inflation converges on target - Reserve Bank of New Zealand - Te Pūtea Matua (rbnz.govt.nz)

2. Reserve Bank of New Zealand (May 2024), OCR 5.50% - Official Cash Rate to remain restrictive

OCR 5.50% - Official Cash Rate to remain restrictive - Reserve Bank of New Zealand - Te Pūtea Matua (rbnz.govt.nz)